Buy Gold, Buy Silver, Buy Platinum, or Buy Copper?

When the pandemic hit the economy hard in 2020, precious metals‘ outlook started to perform like never before.

People are starting to buy gold as Gold prices rose to the ceiling with more than a 10% increase for the economically unstable year.

Today, people are more careful than ever when it comes to investments. Shall a global-scale unfortunate event like Covid-19 happen again, investors should buy gold as hedge funds to protect their financial position.

Because of the price of gold having an excellent performance in 2020, it has become evident to economists that precious metals are an effective safe-haven for monetary value that can protect an investor from bankruptcy.

While most people, beginners especially, only hear about gold investments, there are more metals that can help an investor diversify and further strengthen their portfolio.

What is Portfolio Diversification?

Diversifying one’s portfolio means acquiring different types of investments apart from a primary.

Someone who has stocks might be severely affected by a falling dollar. If that person did invest in gold, which rises in value when the dollar drops, that investor has protected himself from losing money.

Gold is not the only precious metal that can help an individual acquire excellent contingencies for financial or economic troubles. The bullion metals, gold, silver, platinum, and even semiprecious copper have their specific strengths that can supplement each other’s weaknesses.

Bullion Metals

Gold – Benefits When You Buy Gold

Gold has been admired and valued by humanity for centuries, associating the metal with power, dominance, spirituality, and beauty. The foundation by which the modern world treats gold carries most of the historical sentiment that humanity has added to the metal.

Most people will value the metal and buy gold when they can. There will always be someone willing to buy gold or trade something for any amount of the metal.

As emerging economies continue to rise around the world, more and more people upgrade the way they commodify precious metals and start to buy gold. The continuously growing world population alone can be a legitimate indicator that the demand for the metal to rise.

When inflation, deflation, or other economic downswings occur, smart investors know that they can buy gold and use it in place of the dollar.

While some people have been skeptical and think of this contingency as farfetched, 2020 has proven otherwise.

When the dollar value drops, people tend to scramble to get gold in preparation for the worst-case scenario. This rush significantly increases the demand for the metal and consequently skyrockets its price.

Whether the economy is stable or not, buy gold as it is excellent for storing value. The most interest a bank will give is .60%, which is nothing compared to the average increase of the price of gold – 20% since 2018.

Gold is an excellent all-around investment to have. However, there are niches where other metals like silver will perform better.

Silver – Advantages When You Buy Silver

Both gold and silver are excellent conductors of electricity and heat. They can be used for electronics purposes.

Gold, which doesn’t tarnish like silver, can be used for medical uses more than silver. However, because that metal has more added value, producers tend to choose silver for industrial purposes.

Silver is a beautiful metal that is safe for value, just like gold, albeit at a cheaper level. It also naturally increases in price during economic crises because of its status as a practical commodity for industry.

While it is used in jewelry, cutlery, and other aesthetic items, it is highly in demand for electronics. This market is what mostly drives the performance of the metal.

Most electronics contain silver, e.g., fridges, smartphones, smart TVs, cars, computers, and others. Every time a new technology comes around or a new iPhone or Galaxy is released, there will be a spike in the demand for silver.

As the world’s tech continues to develop, the price of silver will be on an inevitable rise.

While it falls behind gold in value, if an investor has a significant amount of silver, the financial benefits can be at par.

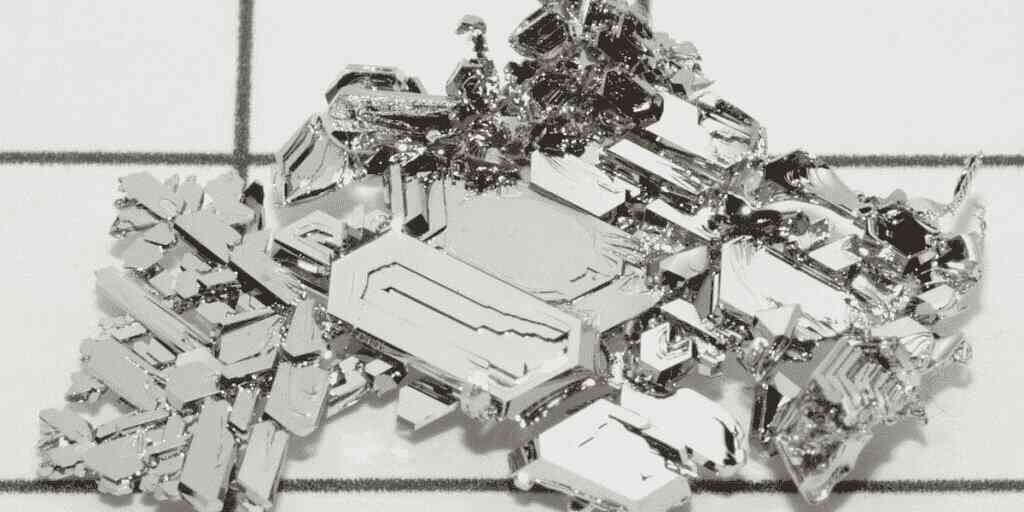

Platinum – The Premium When You Buy Platinum

Platinum and the rest of the platinum group of metals are the rarest of investment metals. When the economy is stable, platinum can double the price of gold.

When a recession occurs, the demand for the metal drops because of its high premiums. The metal is best bought in a year like 2020 and then sold when the economy stabilizes.

Platinum has vital industrial applications. It is used as a catalyst for motor oil. It is highly sought for in the production of sensitive medical apparatuses and electronics.

Like gold, platinum can be impractical for other producers. They turn to silver and copper as cheaper alternatives for conductors and electronic parts. However, for sensitive equipment, platinum is a premium that producers are willing to pay.

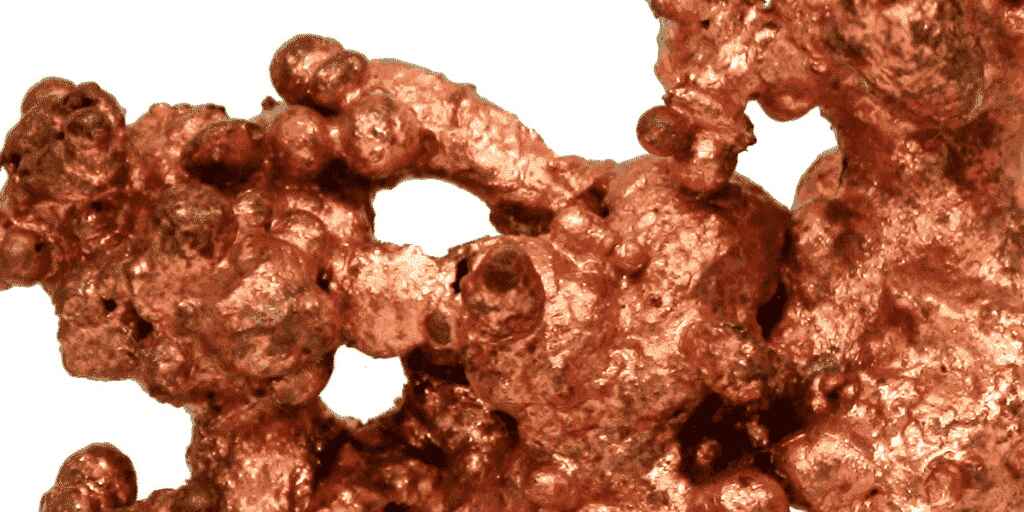

Copper – What do You Get When You Buy Copper?

While this metal is semiprecious, unlike the other three, there is the bullion of this type that will benefit an investor in a simple yet vital way. Copper is cheap, and pieces made of it are naturally of lesser value.

With lower value bullion, an owner can subdivide the value of the collection more accurately.

Someone who owns a 1-kg gold bar but only needs to sell half of it would have to find someone who owns two half-kgs first before completing a sale. If that person had lower value pieces like copper and smaller items of gold, platinum, and silver, he would be able to easily weigh how much is needed to sell.

The advantage of the denomination is not exclusive to copper but to bullion in general. With different sizes and different metals, an investor can easily calculate an exact amount of value to sell.

So, What is The Best Precious Metal?

The Goldilocks’ zone of benefit and practicality goes to gold – it merely is the best investment metal that an investor can have, especially now that anyone can easily buy gold through bullion box subscriptions.

In the olden days, a someone who wanted to buy had to go through voyages, find secure and legitimate sources, appraise, and exert much time and effort just to acquire it. Today, getting gold and other precious metals can be done with one click of a button.

With the availability of bullion via monthly deliveries, any level of investor can easily access precious metals.

About Bullion – Buying Gold Bullion and Other Precious Metals

Bullion comes in gold, silver, and platinum, and at a scale, copper. They come in small to medium sizes, from 1/4oz to 1oz or slightly heavier bars, coins, and other pieces.

With bullion, you not only own gold, but silver, platinum, and copper too. This means that when the price of gold slows its increase when the economy normalizes, you can depend on the platinum you own to keep your value up.

With bullion, when there is a spike in industrial production, you would also have silver to sell.

Getting bullion gives you an advantage in more niche markets than when you’re focusing on just one precious metal.

They are .999 pure and will value the same per weight of metal as other forms. With their small sizes, any investor can gradually grow a precious metals inventory without having to use a massive amount of money at once.

The best way is to order monthly curated bullion boxes. While there are stores where one can choose what to buy, the long catalogs and endless technical menus can be too complicated, especially for beginners.

Without the proper expertise, anyone can easily fall into buying the least ideal items or acquire counterfeits. It would be best to leave the appraisal, selection, and curation to an expert.

Bullionboxsubscriptions – Buy Gold and More!

With our monthly delivery service, you no longer have to worry about researching, evaluating, sourcing, and doing all the highly-technical work required in getting the right precious metals to collect

If you are trying to strengthen your financial position but don’t have the time and technique, it would be best to leave the work to us, the experts.

All you need to do is choose from our different options.

We have a $19 option where you can get fractional silver. Our top tier is at $500, where you can buy gold bullion and other items.

Match your budget with a choice and order. So long as you are subscribed to our service, you can be sure that you will receive the best gold bullion in the market every month.

No more hassles for you, only benefits.

Whether you are a stockholder, have real estate, diversifying your portfolio, looking for a retirement fund, or just want to have a contingency for another year like 2020, it would be best if you buy bullion today.

The earlier you start collecting, the more you will have in time, which means more profits for you in the long run.

Invest in bullion today!

with 700+ reviews

with 700+ reviews