While gold is seen as the classic precious metal and silver often plays second fiddle, there are actually a number of reasons why silver may be a better choice for many investors. For one thing, silver is more affordable than gold, making it a more accessible investment. Additionally, silver is used in a variety of industries, from electronics to solar energy, which means that it has both an industrial and an investment value. Palladium and platinum are also used in industry, but they are not as widely used as silver, making silver a more versatile metal.

Silver: Supply and Demand

While silver may not always react logically to demand and supply, there are still a few things that investors can keep an eye on to get a better sense of the market. First, it’s important to track mine production. This can give you an idea of how much silver is coming onto the market. Additionally, it’s worth monitoring industrial demand, as this is one of the major drivers of silver prices. Lastly, keep an eye on central bank holdings. This can provide insight into whether institutions are bullish or bearish on silver. By tracking these indicators, you can get a better sense of where the market is headed and make more informed investment decisions.

The demand side for silver comes closer to copper than anything else on the industrial side, and it shadows gold on the investment side, until it takes the lead itself, which tends to happen in the final phases of precious metals runs. Maybe the needed trigger on the investment side will finally arrive after many retail investors have been burned on crypto and will be looking elsewhere. Whatever the trigger ends up being, it’s likely that silver will benefit from increased interest in precious metals as an investment safe haven.

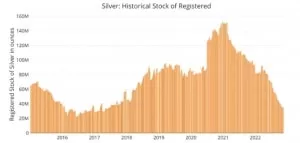

The supply side for silver looks to be diminishing and finally turning into a situation where the storage and above ground material from coins and bars is getting into a deficit position. Recent numbers from the different exchanges indicate that the available ounces are getting less and less, shown by the COMEX registered ounces chart below. LBMA Reserve ounces have also been falling through the year of 2022, even though not as aggressively as COMEX, but the direction is clear; there are fewer silver ounces available above ground.

Looking at the silver price chart below, it’s easy to see why some investors are bullish on the metal. Prices have been climbing steadily for the past year, and there appears to be plenty of room for further gains. Of course, silver is a volatile commodity and prices could turn lower at any time. But from a risk/reward perspective, the bulls have the advantage right now. Should the overall markets get into turmoil again, silver can be expected to follow stocks and copper down, and potentially decouple from gold, but with silver, it’s never a given.

So, Is Investing In Silver Worth It?

Investors who want to get into the silver market can own both physical bullion coins and silver ETFs. Both have their advantages and disadvantages.

Most of the time, it comes down to what they want to buy. Silver is an easy and quick investment for someone who wants money now.

But, if a person believes that the financial system will fall apart, physical silver is the best way to protect yourself.

If you want to get gold or silver or learn about investing in other precious metals, BullionBox is here for you.

with 700+ reviews

with 700+ reviews